Connecting The Disconnect Between Trading & Accounting

Find out why it’s important for trading and accounting departments to understand each other’s functions so the organization can stand up to audit scrutiny.

Trading and accounting departments look at the origination-to-settlement lifecycle differently and this can often lead to disconnects and miscommunication that manifest late in the timeline of ETRM system implementations, resulting in work recycling and a delayed go-live. As is sometimes the case, it can come down to a matter of perspective.

Trading Perspective

Trading is a forward-looking activity seeking ways to capture value in the market whether that be by monetizing transient arbitrage opportunities or leveraging an asset base to best commercial effect. The basic question begins as “How much money can I make with this trade?” and flips immediately to “How much money has this trade made?” as soon as the deal is consummated. From a front-office perspective, this is one of the measurements of “success.”

READ MORE: Key Considerations For Improving Your Business Processes & ETRM System Implementation

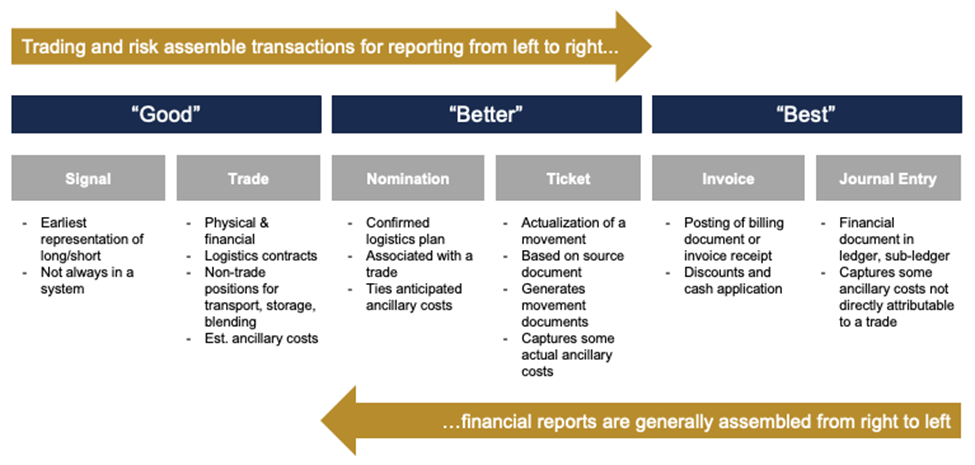

Trading business processes are mostly focused on items such as counterparty credit checks, compliance approvals, mark-to-market (MtM) reporting, and profit and loss (P&L). Even system features are looked at through a narrow trading view: Are all the price feeds interfacing correctly? Are the curves configured? Are the price formula templates available for the trade? Additionally, most of the reporting views are internally oriented and built for the specific needs of a business. These reports are generated daily and often intraday. Whenever there’s a question or issue, the investigation starts with the trade and then works its way back through scheduling, actualization, and accounting.

Accounting Perspective

It’s an oversimplification, certainly, but conversely, accounting takes a rear-view perspective on the business and its performance. The basic question for accounting becomes: “What are the results and how do we know they are complete and accurate?” This lens is carefully constructed to conform to specific external accounting standards (i.e., GAAP, IFRS), and it moves to a different rhythm monthly, quarterly, and yearly.

Special treatments like a U.S. refiner taking last in-first out (LIFO) for inventory, hedge accounting, revenue reconciliation, and so forth can result in deltas that aren’t always easy to explain to the layperson. All of this must be well substantiated and held up under the scrutiny of an audit. As mentioned previously, front-office reporting views are primarily internal; however, GAAP and IFRS standards are used to drive external reporting that’s used for public financial statements and investor analysis. With the continued progress of converging GAAP and IFRS and the recently established International Sustainability Standards Board (ISSB), reporting standards will continue to evolve.

There are transactional trickle-down effects as well. Traders may enter into deals, both physical and paper, which can have real tax and accounting implications, and often the back-office is responsible for understanding the impact, ensuring the correct profit and cost centers are affected (or potentially creating new ones) and taxes are being calculated and reported on accurately. Another example is inventory valuation. Often traders are looking at necessary supply trading or trades that are the most profitable market plays whereas accounting may be valuing inventory and reporting based on different valuation methods such as WACOG, LIFO, or FIFO, which may present a disconnect with each of their respective goals.

These examples mean there’s a need for integrated systems that can support the back-office with these ever-changing reporting requirements and transactional activity. For accounting, when there’s a discrepancy or audit inquiry, the analysis starts with the accounting transactions themselves, then actualization, then scheduling, and finally the trade as the last step in the investigation. This is the opposite approach compared to the front-office process outlined earlier.

Bridging The Gap Between Trading & Accounting

Each discipline has its own set of acronyms and jargon that require some “translation.” It’s prudent for trading to understand the downstream implications of its role within the ETRM. If not performed correctly, trading activity can have a ripple effect that can result in either a delay in the generation of financial statements or inaccurate reporting, which could result in investor backlash.

READ MORE: 10 Ways To Build Layers Of New Value Around Your ETRM System

On the other hand, the more the accounting department understands the organization’s trading strategy and activity, the more it’s equipped to be able to explain discrepancies to auditors. Investing time and energy up front to educate stakeholders across the enterprise on the foundational concepts will pay dividends and can help avoid nasty surprises in user acceptance testing (UAT) or, worse, post go-live.

At Opportune, not only do we help clients ensure that their trading P&L and financial reports are correct, but we can add value by bridging the gap between the two.

About The Expert

Katie-Rose Herd is a Director in the Process & Technology practice at Opportune LLP. She has over 10 years of experience in the energy industry with an emphasis on oil and gas where she defines, selects, and implements ETRM solutions and business process resolutions that further enable effective management of clients’ commodities portfolios. Katie-Rose specializes in midstream and downstream offerings and has experience in front-, middle- and back-office with her involvement in the end-to-end trading lifecycle. In addition, she provides overall support for clients within their commodity trading organization. Katie-Rose has a B.A. in Economics from the University of Texas at Austin and a McCombs Business Foundations Certificate.

Related Insights

Our experts are here

for you.

When you choose Opportune, you gain access to seasoned professionals who not only listen to your needs, but who will work hand in hand with you to achieve established goals. With a sense of urgency and a can-do mindset, we focus on taking the steps necessary to create a higher impact and achieve maximum results for your organization.

LeadershipGeneral Contact Form

Looking for expertise in the energy industry? We’ve got you covered.

Find out why the new landmark legislation should provide a much-needed boost for the development of carbon capture.